Not known Facts About Estate Planning Attorney

Wiki Article

The 15-Second Trick For Estate Planning Attorney

Table of Contents3 Easy Facts About Estate Planning Attorney ExplainedThe Best Guide To Estate Planning AttorneySome Known Questions About Estate Planning Attorney.Everything about Estate Planning Attorney

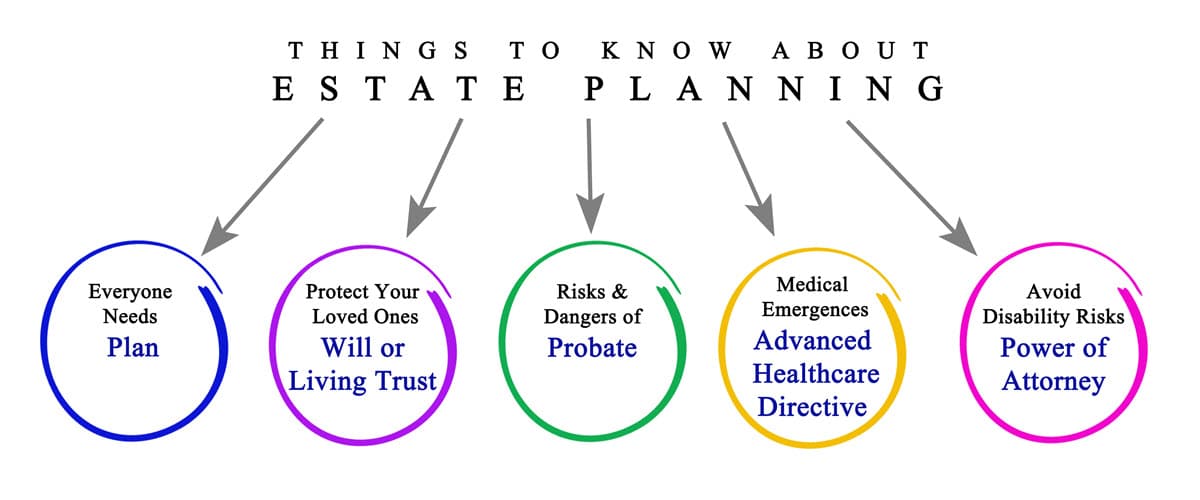

Estate planning is an action plan you can use to establish what occurs to your properties and obligations while you live and after you die. A will, on the other hand, is a legal file that outlines exactly how assets are distributed, that cares for children and animals, and any kind of other desires after you pass away.

Insurance claims that are turned down by the executor can be taken to court where a probate judge will have the final say as to whether or not the case is valid.

Estate Planning Attorney - An Overview

After the supply of the estate has actually been taken, the value of possessions determined, and taxes and financial obligation paid off, the administrator will then look for authorization from the court to distribute whatever is left of the estate to the beneficiaries. Any kind of inheritance tax that are pending will certainly come due within 9 months of the day of fatality.

Each private areas their possessions in the trust fund and names a person apart from their spouse as the beneficiary. However, A-B depends on have actually come to be much less popular as the inheritance tax exception functions well for the majority of estates. Grandparents may transfer properties to an entity, such as a 529 plan, to sustain grandchildrens' education.

How Estate Planning Attorney can Save You Time, Stress, and Money.

Estate organizers can deal with the donor in order to decrease taxed earnings as a result of those payments or create methods that maximize the impact of those donations. This is an additional technique that can be utilized to restrict death taxes. It entails a private locking in More about the author the existing worth, and hence tax obligation liability, of their residential property, while attributing the worth of future development of that resources to another individual. This technique entails freezing the worth of a property at its worth on the day of transfer. Accordingly, the amount of prospective funding gain at fatality is additionally frozen, permitting the estate organizer to approximate their prospective tax obligation liability upon death and much better strategy for the payment of earnings taxes.If adequate insurance earnings are readily available and the policies are appropriately structured, any earnings tax obligation on the considered personalities of assets adhering to the death of an individual can be paid without considering the sale of properties. Proceeds from life insurance that are obtained by the recipients more info here upon the fatality of the guaranteed are usually income tax-free.

Other fees connected with estate planning include the preparation of a will, which can be as low as a few hundred bucks if you utilize one of the finest online will makers. There are specific files you'll need as part of the estate planning process - Estate Planning Attorney. Some of one of the most usual ones consist of wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a misconception that estate planning is just for high-net-worth people. Estate planning makes it less complicated for people Get More Information to determine their dreams prior to and after they die.

Our Estate Planning Attorney Statements

You should start intending for your estate as quickly as you have any measurable property base. It's an ongoing process: as life advances, your estate strategy need to change to match your conditions, in line with your new goals.Estate planning is usually taken a tool for the rich. Yet that isn't the instance. It can be a helpful method for you to take care of your properties and liabilities before and after you die. Estate planning is likewise a wonderful way for you to lay out plans for the care of your minor children and animals and to describe your long for your funeral service and favored charities.

Eligible applicants that pass the test will certainly be officially certified in August. If you're eligible to rest for the test from a previous application, you might submit the short application.

Report this wiki page